Getting Started

Decide the payment journeys you need

We have a range of payment journeys to choose from to optimise your user's payment experience Use this page to help you understand which journey you need to implement across Payins and Payouts:

Payins:

Payins - This journey enables an account to account payment, that allows a user to select their bank and initiate a secure payment using their chosen banking application.

Enhanced Payins - This payment flow provides the same user experience as Payins. On the completion of the payment, Yaspa verifies the identity and account details of the user making a payment.

In Europe - We return the Account Name, IBAN of the Payer

In UK - We return the Account Name, Account Number and Sort Code

Payouts:

Payout Journeys are typically used when sending a refund, withdrawal or compensation to a user.

Verified Payout - Enabling an account to account payment to a user, using Open Banking Account Verification to connect the bank account to securely capture the user's account details before submitting the Payout request.

Verified Payout with manual iban input - Enabling an account to account payment to a user by enabling them to connect their bank or input their bank account details manually before securely requesting a Payout.

Direct Payout - Enabling an A2A payment to a user on a merchant interface

Enabling an account to account payment to a user, using bank account information collected during the Enhanced Payment flow, to provide a closed-loop payout request to be submitted by the merchant interface.

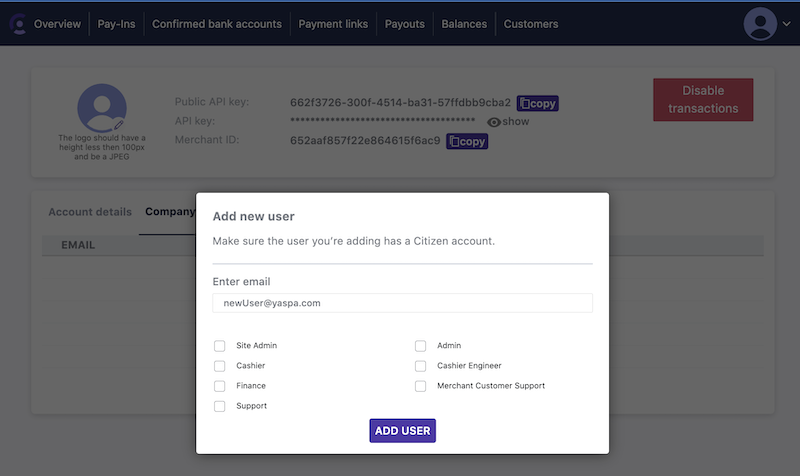

Creating your account & adding your business information

To get started with Yaspa, you’ll need to register and log into the Admin Backoffice.

Access is by invitation only, so if you haven’t received an invite, please contact your Customer Success Manager.

Going Live

You can integrate and test in our sandbox (test) environment, which fully replicates the live environment.

Once you are happy with your integration, you can go live simply by changing API keys.

Integrating Pay-Ins

Yaspa lets you take pay-ins from customers, directly from their bank account.

The Yaspa Pay SDK is a few lines of Javascript, called from your pay-in page.

Adding the JS Pay-In SDK to your page

Javascript: Adding the JS Pay-In SDK

<script src="https://sdk.yaspa.com/v6/sdk/sdk-payin.js" data-api-key="[Your-merchant-public-api-key]"></script>

<script src="https://test-sdk.yaspa.com/v6/sdk/sdk-payin.js" data-api-key="[Your-merchant-public-api-key]"></script>

Javascript: Adding the JS Pay-In SDK programmatically

function setupCitizenSdk() {

let scriptTag = document.createElement('script');

scriptTag.src = "https://sdk.yaspa.com/v6/sdk/sdk-payin.js";

scriptTag.dataset.apiKey = "[Your-merchant-public-api-key]"

document.body.appendChild(scriptTag)

}

//Then you can call the function on which point you want to load the sdk

setupCitizenSdk()

function setupCitizenSdk() {

let scriptTag = document.createElement('script');

scriptTag.src = "https://test-sdk.yaspa.com/v6/sdk/sdk-payin.js";

scriptTag.dataset.apiKey = "[Your-merchant-public-api-key]"

document.body.appendChild(scriptTag)

}

//Then you can call the function on which point you want to load the sdk

setupCitizenSdk()

The SDK is a Javascript library that you link to from your page.

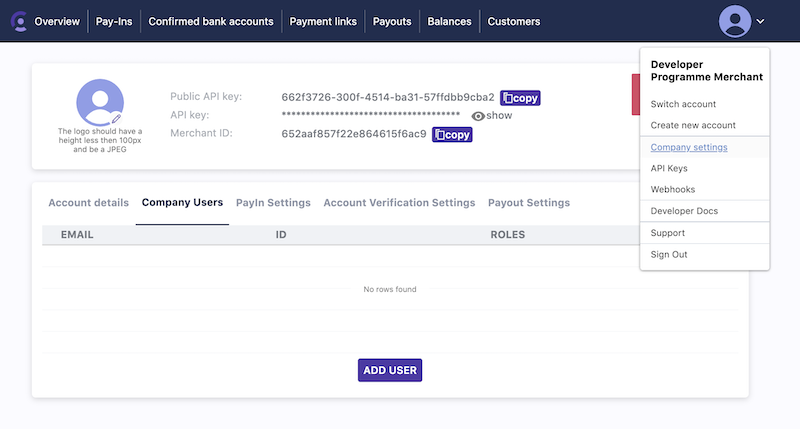

You can find your public api key in the dashboard in your merchant information page.

Checking that our SDK has been loaded and is ready to be used

Javascript: Check the readiness of the SDK

window.CITIZEN_PAYIN.ready().then(() => {

//in this point the sdk is ready to be used

})

window.CITIZEN_PAYIN.ready().then(() => {

//in this point the sdk is ready to be used

})

You are able to check if the CITIZEN_PAYIN is ready to be used calling the function .ready() of the SDK.

This will return a promise

that will be resolved when SDK is ready to be used.

Creating the Pay-In Instruction

Java: Creating a Pay-In Session

public class CitizenTransactionDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private static final long serialVersionUID = 212345678976543210L;

private String paymentGiro; //Either FPS or SEPA

private String customerIdentifier; // The internal id you use on your systems to identity your user

private String customerEmailAddress;

private String amount;

private String currency; // has to be a valid currency ISO code e.g. USD, EUR, GBP

private String reference;

private String description;

private String customerIpAddress;

private String customerDeviceOs;

private String searchableText;

private String payload;

private boolean isPayloadEncrypted;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String successRedirectUrl;

private String failureRedirectUrl;

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-pay-in-endpoint")

public class PayInEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-pay-in-endpoint")

public Callable<ResponseEntity<TextNode>> createCitizenPayInTransaction(TransactionDetails details) {

CitizenTransactionDetails citizenPayInDetails = new CitizenTransactionDetails();

citizenPayInDetails.setCustomerEmailAddress(DB.getCustomerEmail);//only needed for email journey

citizenPayInDetails.setCustomerIdentifier(DB.getCustomerId);//should be the id of the customer's account on the merchant's internal system.

citizenPayInDetails.setAmount(details.getAmount);

citizenPayInDetails.setCurrency("GBP");

citizenPayInDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayInDetails.setReference("This is my reference");

citizenPayInDetails.setDescription("This is my description");

citizenPayInDetails.setCustomerIPAddress(details.getIPAddress());

citizenPayInDetails.setCustomerDeviceOs(details.getOS());

citizenPayInDetails.setSearchableText(details.getSearchableText());

citizenPayInDetails.setPayload(details.getPayload());

citizenPayInDetails.setIsPayloadEncrypted(details.getIsPayloadEncrypted());

citizenPayInDetails.setSupportedCountries(DB.getSupportedCountries());

citizenPayInDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

citizenPayInDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

citizenPayInDetails.setBankSuccessRedirectUrl("<my-bank-success-redirect-url>");

citizenPayInDetails.setBankFailureRedirectUrl("<my-bank-failure-redirect-url>");

citizenPayInDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("AuthorizationCitizen", [YOUR_MERCHANT_PRIVATE_API_KEY]]);

ResponseEntity<TextNode> payInInitResponse = restTemplate

.exchange("https://api.yaspa.com/v2/payins/session", HttpMethod.POST,

new HttpEntity<>(citizenPayInDetails, httpHeaders), TextNode.class);

String citizenTransactionId = payInInitResponse.getBody().asText();

return ResponseEntity.ok(new TextNode(citizenTransactionId)); //Return this to your front end

}

}

public class CitizenTransactionDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private static final long serialVersionUID = 212345678976543210L;

private String paymentGiro; //Either FPS or SEPA

private String customerEmailAddress;

private String merchantEmailAddress;

private String amount;

private String currency; // has to be a valid currency ISO code e.g. USD, EUR, GBP

private String reference;

private String description;

private String customerIpAddress;

private String customerDeviceOs;

private String searchableText;

private String payload;

private boolean payloadEncrypted;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String successRedirectUrl;

private String failureRedirectUrl;

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-pay-in-endpoint")

public class PayInEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-pay-in-endpoint")

public Callable<ResponseEntity<TextNode>> createCitizenPayInTransaction(TransactionDetails details) {

CitizenTransactionDetails citizenPayInDetails = new CitizenTransactionDetails();

citizenPayInDetails.setCustomerEmailAddress(DB.getCustomerEmail);//only needed for email journey

citizenPayInDetails.setCustomerIdentifier(DB.getCustomerId);//should be the id of the customer's account on the merchant's internal system.

citizenPayInDetails.setAmount(details.getAmount);

citizenPayInDetails.setCurrency("GBP");

citizenPayInDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayInDetails.setReference("This is my reference");

citizenPayInDetails.setDescription("This is my description");

citizenPayInDetails.setCustomerIPAddress(details.getIPAddress());

citizenPayInDetails.setCustomerDeviceOs(details.getOS());

citizenPayInDetails.setSearchableText(details.getSearchableText());

citizenPayInDetails.setPayload(details.getPayload());

citizenPayInDetails.setIsPayloadEncrypted(details.getIsPayloadEncrypted());

citizenPayInDetails.setSupportedCountries(DB.getSupportedCountries());

citizenPayInDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

citizenPayInDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

citizenPayInDetails.setBankSuccessRedirectUrl("<my-bank-success-redirect-url>");

citizenPayInDetails.setBankFailureRedirectUrl("<my-bank-failure-redirect-url>");

citizenPayInDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("AuthorizationCitizen", [YOUR_MERCHANT_PRIVATE_API_KEY]]);

ResponseEntity<TextNode> payInInitResponse = restTemplate

.exchange("https://testapi.yaspa.com/v2/payins/session", HttpMethod.POST,

new HttpEntity<>(citizenPayInDetails, httpHeaders), TextNode.class);

String citizenTransactionId = payInInitResponse.getBody().asText();

return ResponseEntity.ok(new TextNode(citizenTransactionId)); //Return this to your front end

}

}

Setting up a pay-in in your backend is simple, and requires a number of fields set.

| Parameter | Description | Type | Required |

|---|---|---|---|

| customerIdentifier | The internal id you use on your systems to identity your user | string | Y |

| customerEmailAddress | The email of the paying customer. Only needed for email journey | string | N |

| paymentGiro | payment type (SEPA or FPS) | string | Y |

| amount | decimal value of the payment | string with valid 2 decimal number format | Y |

| currency | currency | string with valid ISO currency code | Y |

| reference | payment reference shown to the customer. Needs to be alphanumeric and 15 chars max. This MUST be unique | string | Y |

| description | description shown to the customer | string | N |

| customerIpAddress | IP for the paying customer | string with valid IPv4 or IPv6 format | Y |

| customerDeviceOs | OS for the paying customer | string | Y |

| searchableText | searchable string | string | N |

| payload | meta-data of the payment | string | N |

| isPayloadEncrypted | encrypt payload field (true/false) | boolean | N |

| supportedCountries | filter the bank list in bank selection page | array of string country ISO codes | N |

| successRedirectUrl | Url that the user is redirected to from the modal on completion of a successful journey | string | N |

| failureRedirectUrl | Url that the user is redirected to from the modal when closing the modal or on a failed payment | string | N |

| successBankRedirectUrl | Url that the user is redirected to from their bank app on a successful approval | string | N |

| failureBankRedirectUrl | Url that the user is redirected to from their bank app on a cancelled/failed request | string | N |

| language | The language that will be used to translate the journey | string of language ISO-639-1 code. Default value 'en' | N |

Starting the Pay-In Journey

Javascript: Starting the Email Pay-In Journey

<script>

// citizenTransactionId - from the previous step

// options - an object that can contain the following fields:

// 1. customerEmailAddress - the email of the user, it used to show the user on which email the email has sent

// 2. initiatedCallback - a callback that is triggered when the background work is done and the modal is shown.

// Used mostly to handle the loading state of the host page. If non is passed, the loading state is handled from the modal

//

// e.g. const options = {

// customerEmailAddress: "yourCustomerEmail@gmail.com",

// initiatedCallback: function(){console.log("This function called when the modal is about to open")}

// }

let sendPayIn = function (citizenTransactionId, options) {

window.CITIZEN_PAYIN.startEmailPayInJourney(citizenTransactionId, options);

}

</script>

Once you have the citizenTransactionId, you can start the pay-in journey modal.

Available Parameters

| Parameter | Description | Type | Required |

|---|---|---|---|

| citizenTransactionId | string of the transaction ID generated from previous step | String | Y |

| options | Options that are used for a better user experience. Available options : 1. customerEmailAddress - the user email that used to create the session, it used to show the user in which email the link is send 2. initiatedCallback - a callback that is triggered when the modal is ready to start the journey |

Object | N |

Starting the Pay-In Journey (Direct Pay-Ins)

You may not want the user to be sent an email to begin their pay-in journey. For this, we offer a way to start the

journey on the current page.

This call will redirect the user from the current page to a consent page with the details of the journey.

Javascript: Starting the Pay-In Journey

<script>

// citizenTransactionId - from the previous step

let sendPayIn = function (citizenTransactionId) {

window.CITIZEN_PAYIN.startPayInJourney(citizenTransactionId);

}

</script>

Once you have the citizenTransactionId, you can start the pay-in journey.

Starting the QR code Pay-In Journey

You may not want the user to be sent an email to begin their pay-in journey. For this, we offer a way to show to the user

a QR code, where he will be able to scan it and continue the journey on his device.

Javascript: Starting the QR code Pay-In Journey

<script>

// citizenTransactionId - from the previous step

let sendQRCodePayIn = function (citizenTransactionId) {

window.CITIZEN_PAYIN.startQRCodePayInJourney(citizenTransactionId);

}

</script>

Once you have the citizenTransactionId, you can start the pay-in journey.

Customising the Pay-In journey

Yaspa offers a range of options to suit your own pay-in screen, and optimise for customer conversion.

Embedded

You can use our customisable widget to easily add Yaspa pay-ins directly to the pay-in page. This works best when you have a dedicated pay-ins page with space to set customer expectations (key for conversion)

Modal

This method takes the customisable widget and puts it in a modal which will open with the explanatory information when the pay button is clicked. This is best when you have less space available on your page.

Window

The new window option is best for mobile applications. This takes the pay-in experience and hosts it in a new window away from the application when they pay button is clicked. This means there is no need for separate android, iOS or web app integrations.

Custom

Of course - you can always start from scratch and build something unique to your site. We’ll always be on hand to help advise on best practices and share learnings from our own user research.

You can customise your own widget here.

Adding Pay-In component to your page

Javascript: Adding the Pay-In component

<script src="https://sdk.yaspa.com/component/v3/citizen-pay-component.js"></script>

// This is where the pay-in component javascript will be loaded.

// In case of standalone, this is where the component will be shown.

<div id="citizen-pay-component"></div>

<script src="https://test-sdk.yaspa.com/component/v3/citizen-pay-component.js"></script>

// This is where the pay-in component javascript will be loaded.

// In case of standalone, this is where the component will be shown.

<div id="citizen-pay-component"></div>

The Pay-In component is a Javascript library that you link to from your page. You will need to add a div to host the component.

Implement Pay-In Component

Javascript: Initialising pay-in component

<script>

window.citizenAsyncInit = function () {

window.CITIZEN_PAY_COMPONENT.init({

paymentDetails: {

publicApiKey: 'your merchant public api key',

amountToShow: 'amount that will shown to the button. If left blank, a text placeholder will replace it',

currencyToShow: 'currency symbol that will shown to the button. If left blank, a text placeholder will replace it',

},

theme: 'screen theme, posible values light, dark. Default value light',

paymentType: 'the type of the journey, possible values no-email, email. Default value email.',

mode: 'type of the screen. Possible values standalone, modal, windowed. Default value standalone.'

style: 'styles that are passed to style the component.'

})

};

</script>

You initialise the pay-in component with just your merchant public API key and the transaction id.

You can find your public api key the dashboard in your merchant information page and you can generate the transaction id following this step

The transaction id should be passed into the component via the startPayInJourney function. In case of modal and windowed mode, the function startPayInJourney it will open the modal, or the window that will contain the component.

| Parameter | Description | Type | Required |

|---|---|---|---|

| publicApiKey | your merchant public api key | string | Y |

| paymentType | the type of the journey, possible values no-email, email. | string | Y |

| amountToShow | The amount that will shown to the button. If left blank, a text placeholder will replace it | string with valid number format | N |

| currencyToShow | The currency symbol that will shown to the button. If left blank, a text placeholder will replace it | string with valid ISO currency code | N |

| theme | screen theme, posible values light, dark. Default value light | string | N |

| mode | type of the screen. Possible values standalone, modal and windowed. Default value standalone. | string | N |

| style | styles that are passed to style the component. | object | N |

Javascript: Setting the citizenTransactionId into component.

<script>

const openPayInComponent = (citizenTransactionId, customerEmalAddress) => {

window.CITIZEN_PAY_COMPONENT.startPayInJourney(citizenTransactionId, customerEmalAddress)

}

</script>

startPayInJourney Parameters

| Parameter | Description | Type | Required |

|---|---|---|---|

| citizenTransactionId | The transaction id is generated on this step. | string | Y |

| customerEmailAddress | your customer email, this is for visual only, and it will be used only on email payment journey | string | N |

Possible style parameters

All the sections parameters can have their styles changed for attributes fontFamily, backgroundColor and color. e.g. container: { backgroundColor: "white", color: "black" fontFamily: "Roboto" }

| Parameter | Description | Type |

|---|---|---|

| container | the container that contains all the elements | object |

| title | the title that contains the text "Pay direct from your bank" | object |

| description | the text that has the three ticks | object |

| steps | the container of the 2 steps icons | object |

| actionText | the text above the button | object |

| button | the button on the bottom. | object |

Redirects from banks

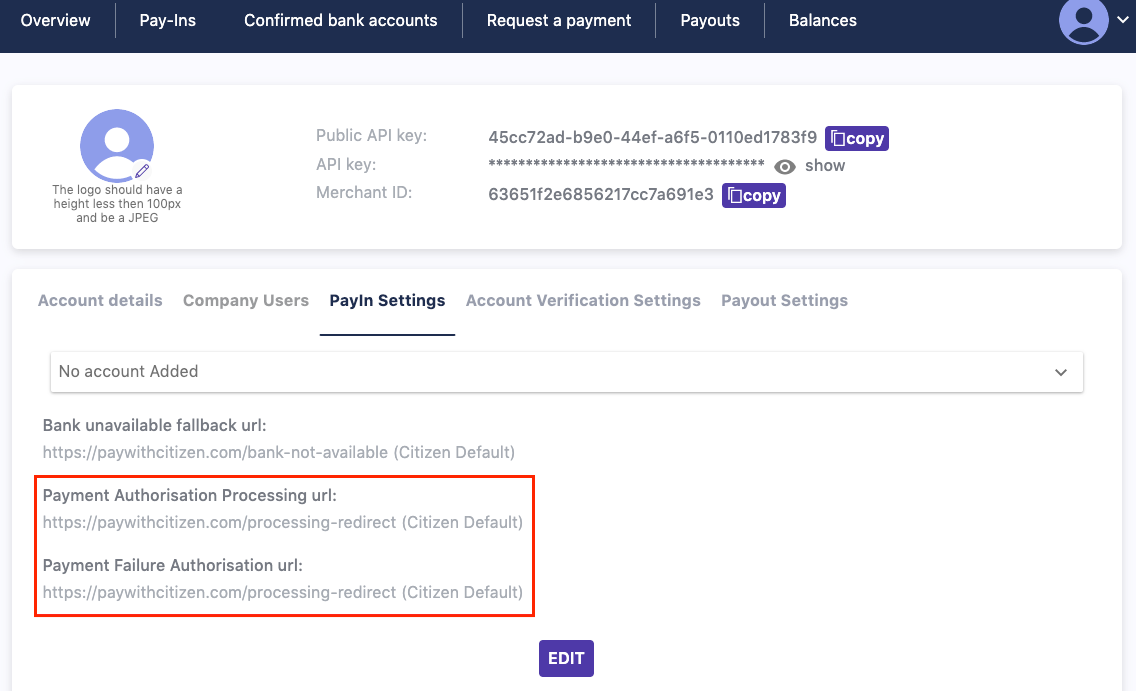

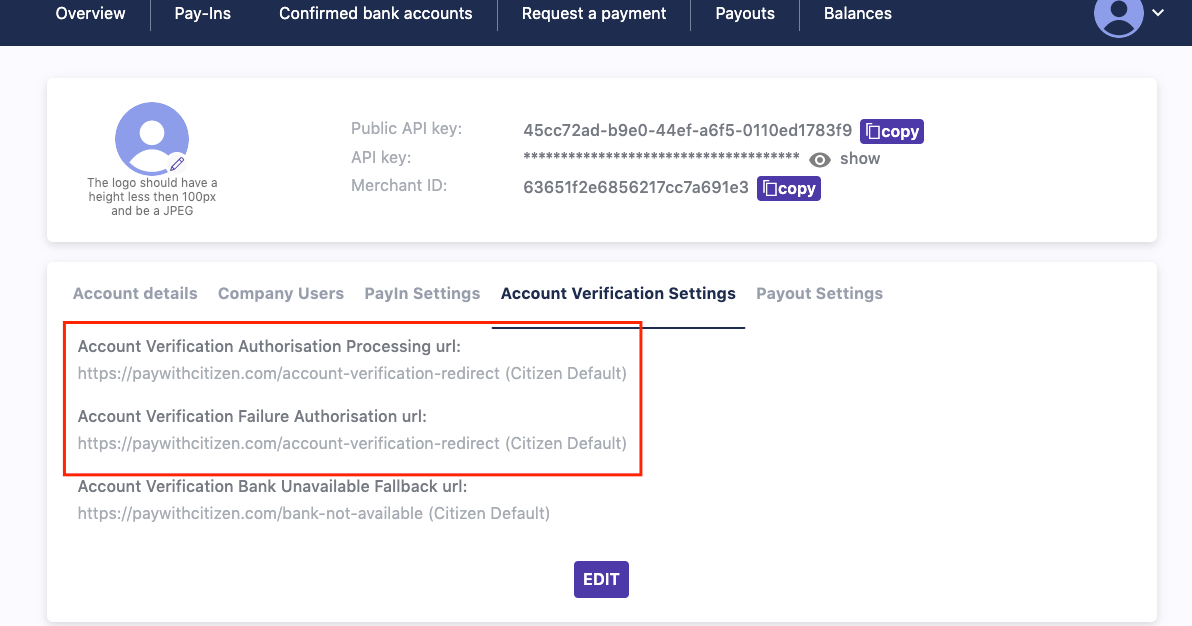

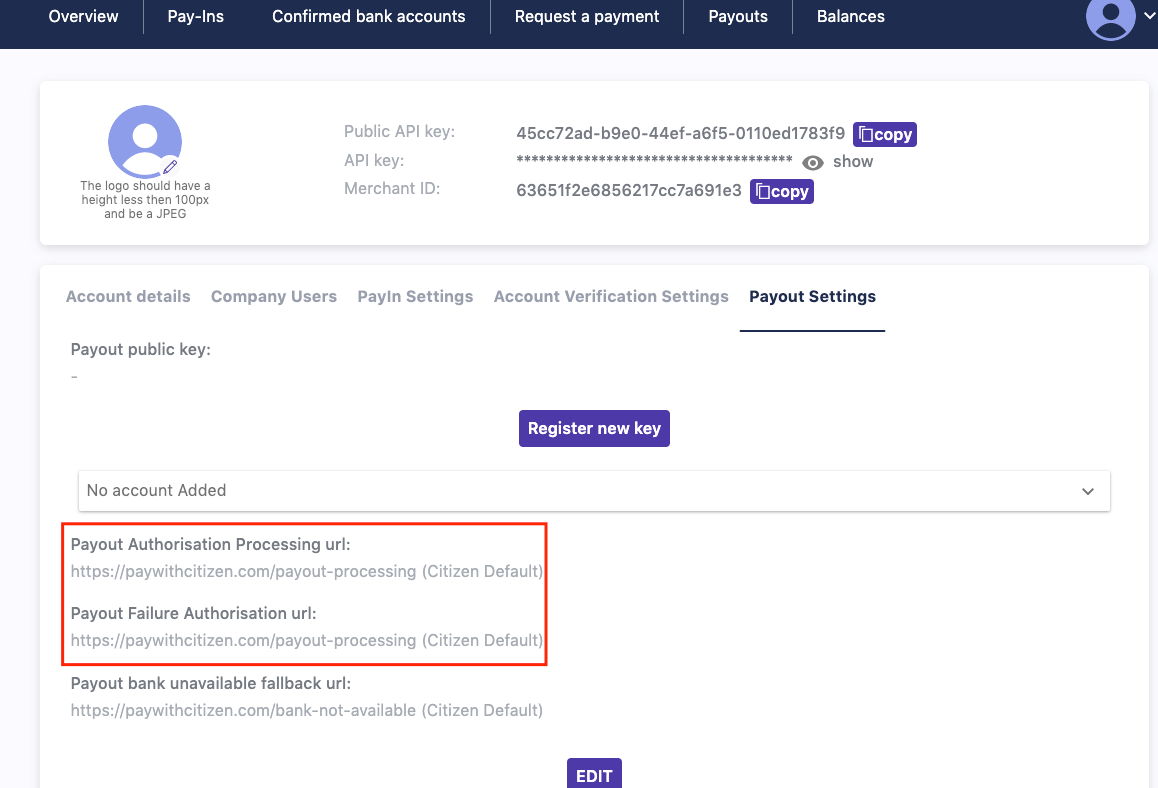

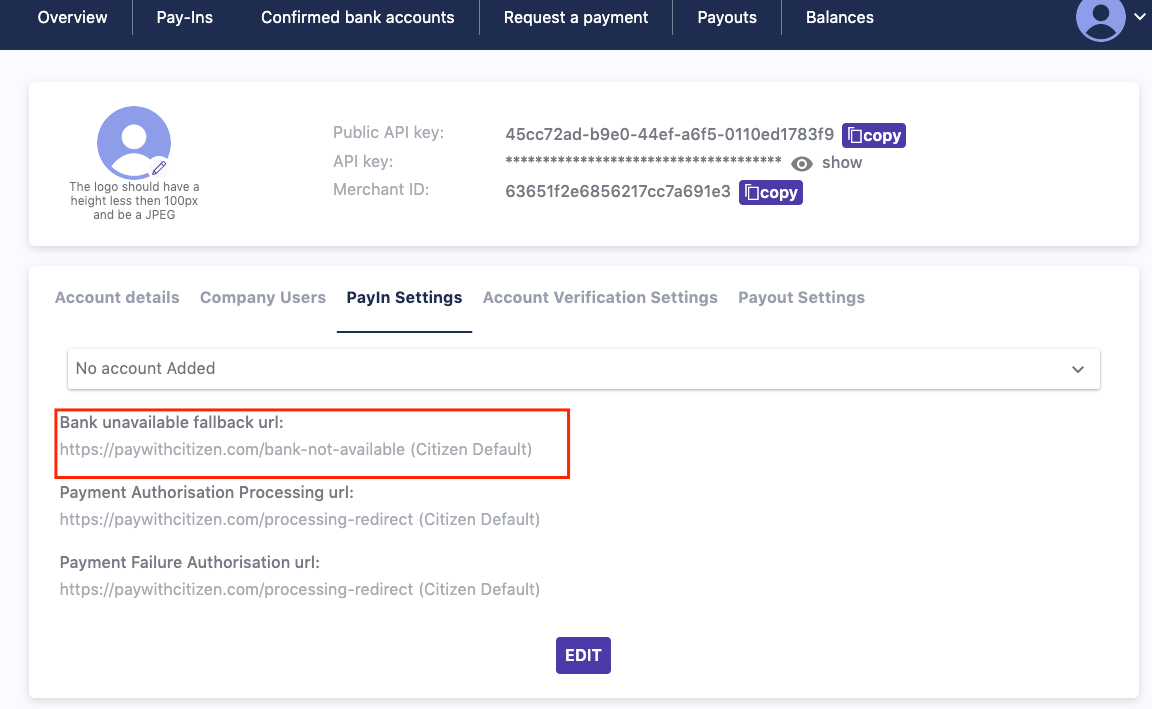

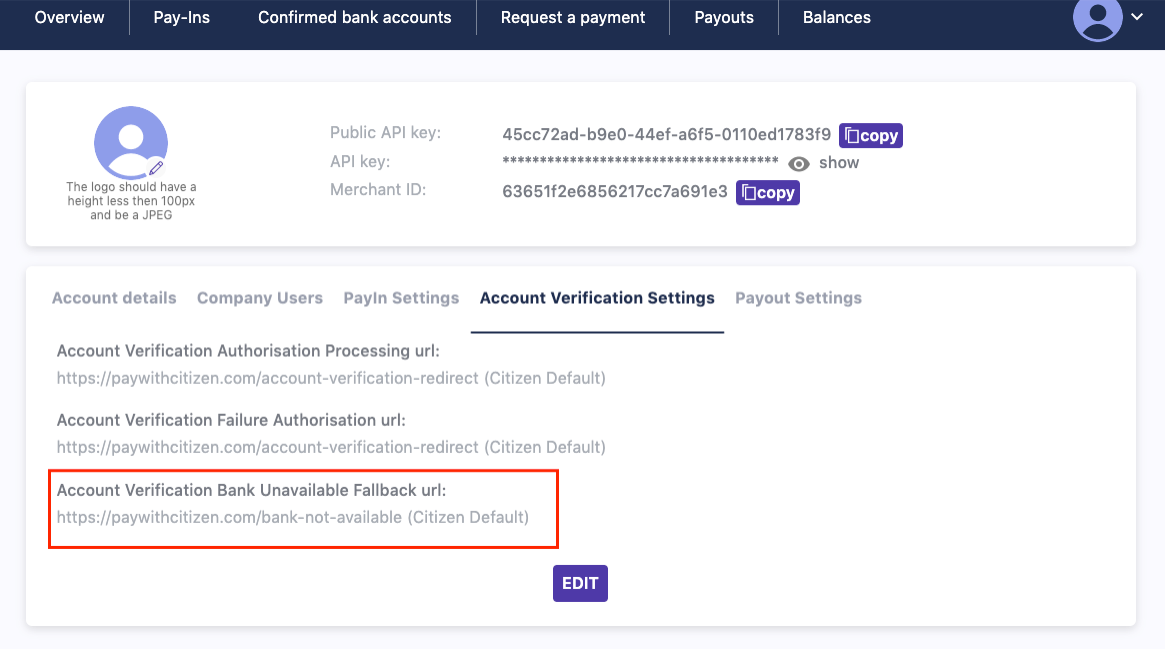

Once a user has completed the authorisation of a pay-in within their banking app we allow you to customise where the customer is redirected to. You can assign unique redirects for both a successful and failure journeys.

You can set these redirect in your admin dashboard under your merchant details.

Pay-In Webhooks

You can receive real time pay-in status updates via webhooks.

Configuring the webhooks you receive can be done in your merchant dashboard.

See here for webhook JSON structure & composition.

Viewing Pay-Ins

We provide all customers with access to their own Yaspa dashboard where they can see pay-in summaries and search for pay-ins.

You also have the option of displaying this data to your own systems using our Pay-In API.

Going Live with Payments

Providing 5AMLD KYC

Yaspa is an authorised payment institute, regulated by the UK Financial Conduct Authority.

We are required to check all of our merchants under the 5AMLD before you can receive payments.

We have made this simple for you; simply follow the instructions here once you have created your entity account.

Testing Payments

You can test payments using the Yaspa test bank on our test platform.

Additionally, you can use a live bank to send a 10p donation to charity using our receiving charity bank account.

Updating your receiving bank

Once we have validated your KYC information, you will be required to validate your bank account information. You can do this in two ways:

- Calling us and providing your entity’s API key and banking information

- Granting a AHC token using the Yaspa mobile app to your admin email

In both cases we will need to see a copy bank statement which confirms your entity’s legal name prior to go-live.

Integrating Accountholder Verification

Yaspa lets you confirm bank account holder information from customers. (this is often referered to as AIS, Account Information Services, in Open Banking).

The Yaspa Accountholder Verification SDK is a few lines of Javascript, called from your customer verification/onboarding page.

Adding the JS Accountholder Verification SDK to your page

Javascript: Adding the JS Accountholder Verification SDK

<script src="https://sdk.yaspa.com/v6/sdk/sdk-account-verification.js" data-api-key="[Your-merchant-public-api-key]"></script>

<script src="https://test-sdk.yaspa.com/v6/sdk/sdk-account-verification.js" data-api-key="[Your-merchant-public-api-key]"></script>

Javascript: Adding the JS account verification SDK programmatically

function setupCitizenSdk() {

let scriptTag = document.createElement('script');

scriptTag.src = "https://sdk.yaspa.com/v6/sdk/sdk-account-verification.js";

scriptTag.dataset.apiKey = "[Your-merchant-public-api-key]"

document.body.appendChild(scriptTag)

}

//Then you can call the function on which point you want to load the sdk

setupCitizenSdk()

function setupCitizenSdk() {

let scriptTag = document.createElement('script');

scriptTag.src = "https://test-sdk.yaspa.com/v6/sdk/sdk-account-verification.js";

scriptTag.dataset.apiKey = "[Your-merchant-public-api-key]"

document.body.appendChild(scriptTag)

}

//Then you can call the function on which point you want to load the sdk

setupCitizenSdk()

The SDK is a Javascript library that you link to from your page

You can find your public api key in the dashboard in your merchant information page.

Checking that our SDK has been loaded and is ready to be used

Javascript: Check the readiness of the SDK

window.CITIZEN_ACCOUNT_VERIFICATION.ready().then(() => {

//in this point the sdk is ready to be used

})

window.CITIZEN_ACCOUNT_VERIFICATION.ready().then(() => {

//in this point the sdk is ready to be used

})

You are able to check if the CITIZEN_ACCOUNT_VERIFICATION is ready to be used calling the function .ready() of the SDK.

This will return a promise

that will be resolved when SDK is ready to be used.

Initialising the Accountholder Verification SDK

Javascript: Initialising the JS Accountholder Verification SDK

<script>

window.citizenAsyncInit = function () {

CITIZEN_ACCOUNT_VERIFICATION.init({

publicApiKey: '[Your-entity-public-api-key]'

})

};

</script>

You initialise the Accountholder Verification SDK with your entity public API key:

You can find your public api key the dashboard in your company information page.

Creating the Accountholder Verification Instruction

Java: Creating an Accountholder Verification Session

public class AHCTransactionDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private String customerEmailAddress;

private String getScopes;

private String getMerchantId;

private String searchableText;

private String payload;

private boolean payloadEncrypted;

private List<String> supportedCountries; //(Optional) has to be an array of valid country ISO codes e.g GB, NL

private String successRedirectUrl;

private String failureRedirectUrl;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-ahc-endpoint")

public class AHCEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-payment-endpoint")

public Callable<ResponseEntity<TextNode>> createCitizenAHCTransaction(AHCTransactionDetails details) {

AHCTransactionDetails aisDetails = new AHCTransactionDetails();

aisDetails.setCustomerEmailAddress(DB.getCustomerEmail);//only needed for email journey

aisDetails.setCustomerIdentifier(details.getMerchantId);//should be the id of the merchants's account.

aisDetails.setScopes(details.getScopes());

aisDetails.setMerchantId(details.getMerchantId());

aisDetails.setSearchableText(details.getSearchableText());

aisDetails.setPayload(details.getPayload());

aisDetails.setPayloadEncrypted(details.getPayloadEncrypted());

aisDetails.setSupportedCountries(DB.getSupportedCountries());

aisDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

aisDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

aisDetails.setBankSuccessRedirectUrl("<my-bank-success-redirect-url>");

aisDetails.setBankFailureRedirectUrl("<my-bank-failure-redirect-url>");

aisDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("AuthorizationCitizen", [YOUR_ENTITY_API_KEY]]);

ResponseEntity<TextNode> AHCInitResponse = restTemplate

.exchange("https://api.yaspa.com/v2/account-verification/session", HttpMethod.POST,

new HttpEntity<>(aisDetails, httpHeaders), TextNode.class);

String citizenAHCTransactionId = AHCInitResponse.getBody().asText();

return ResponseEntity.ok(new TextNode(citizenAHCTransactionId)); //Return this to your front end

}

}

public class AHCTransactionDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private static final long serialVersionUID = 212345678976543210L;

private String customerEmailAddress;

private String getScopes;

private String getMerchantId;

private String searchableText;

private String payload;

private boolean payloadEncrypted;

private List<String> supportedCountries; //(Optional) has to be an array of valid country ISO codes e.g GB, NL

private String successRedirectUrl;

private String failureRedirectUrl;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-ahc-endpoint")

public class AHCEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-payment-endpoint")

public Callable<ResponseEntity<TextNode>> createCitizenAHCTransaction(AHCTransactionDetails details) {

AHCTransactionDetails aisDetails = new AHCTransactionDetails();

aisDetails.setCustomerEmailAddress(DB.getCustomerEmail);//only needed for email journey

aisDetails.setCustomerIdentifier(details.getMerchantId);//should be the id of the merchants's account.

aisDetails.setScopes(details.getScopes());

aisDetails.setMerchantId(details.getMerchantId());

aisDetails.setSearchableText(details.getSearchableText());

aisDetails.setPayload(details.getPayload());

aisDetails.setPayloadEncrypted(details.getPayloadEncrypted());

aisDetails.setSupportedCountries(DB.getSupportedCountries());

aisDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

aisDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

aisDetails.setBankSuccessRedirectUrl("<my-bank-success-redirect-url>");

aisDetails.setBankFailureRedirectUrl("<my-bank-failure-redirect-url>");

aisDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("AuthorizationCitizen", [YOUR_ENTITY_API_KEY]]);

ResponseEntity<TextNode> AHCInitResponse = restTemplate

.exchange("https://testapi.yaspa.com/v2/account-verification/session", HttpMethod.POST,

new HttpEntity<>(aisDetails, httpHeaders), TextNode.class);

String citizenAHCTransactionId = AHCInitResponse.getBody().asText();

return ResponseEntity.ok(new TextNode(citizenAHCTransactionId)); //Return this to your front end

}

}

You can use scopes to set what information you want from the account:

- account_details - just the account information

- transactions_details - just the transaction information

| Parameter | Description | Type | Required |

|---|---|---|---|

| merchantId | Your merchant ID. This can be obtained from your admin dashboard | string | Y |

| customerIdentifier | Used to identify the customer whose bank account details to fetch | string | Y |

| customerEmailAddress | Email address if using the email journey | string | N |

| scopes | the account information that the user will provide to you | array of 'account_details', 'transactions_details' values | Y |

| searchableText | searchable string | string | N |

| payload | meta-data of the request | string | N |

| payloadEncrypted | encrypt payload field (true/false) | boolean | N |

| supportedCountries | filter the bank list in bank selection page | array of string country ISO codes | N |

| successRedirectUrl | Url that the user is redirected to from the modal on completion of a successful journey | string | N |

| failureRedirectUrl | Url that the user is redirected to from the modal when closing the modal or on a failed request | string | N |

| successBankRedirectUrl | Url that the user is redirected to from their bank app on a successful approval | string | N |

| failureBankRedirectUrl | Url that the user is redirected to from their bank app on a cancelled/failed request | string | N |

| language | The language that will be used to translate the journey | string of language ISO-639-1 code. Default value 'en' | N |

Starting the Accountholder Verification Journey (Direct Verification)

Javascript: Starting the Accountholder Verification Journey

<script>

// transactionId - from the previous step

let sendAHCRequest = function (transactionId) {

window.CITIZEN_ACCOUNT_VERIFICATION.startAccountVerificationJourney(transactionId);

}

</script>

Once you have the transaction ID, you can start the accountholder verification journey.

This call will redirect the user from the current page to a consent page with the details of the journey.

Accountholder Verification Webhooks

You can receive real time payment status updates via webhooks.

Configuring the webhooks you receive can be done in your merchant dashboard.

See here for webhook JSON structure & composition.

Viewing Accountholder Verification

We provide all customers with access to their own Yaspa dashboard where they can see account verification.

You also have the option of displaying this data to your own systems using our Accountholder Verification API.

Integrating Verified Pay-Ins

Yaspa lets you take pay-ins from customers after they verify the bank account, directly from the verified bank account.

The Yaspa Pay SDK is a few lines of Javascript, called from your pay-ins page.

Adding the JS Verified Pay-In SDK to your page

Javascript: Adding the JS Verified Pay-In SDK

<script src="https://sdk.yaspa.com/v6/sdk/sdk-verified-payin.js" data-api-key="[Your-merchant-public-api-key]"></script>

<script src="https://test-sdk.yaspa.com/v6/sdk/sdk-verified-payin.js" data-api-key="[Your-merchant-public-api-key]"></script>

Javascript: Adding the JS Verified Pay-In SDK programmatically

function setupCitizenSdk() {

let scriptTag = document.createElement('script');

scriptTag.src = "https://sdk.yaspa.com/v6/sdk/sdk-verified-payin.js";

scriptTag.dataset.apiKey = "[Your-merchant-public-api-key]"

document.body.appendChild(scriptTag)

}

//Then you can call the function on which point you want to load the sdk

setupCitizenSdk()

function setupCitizenSdk() {

let scriptTag = document.createElement('script');

scriptTag.src = "https://test-sdk.yaspa.com/v6/sdk/sdk-verified-payin.js";

scriptTag.dataset.apiKey = "[Your-merchant-public-api-key]"

document.body.appendChild(scriptTag)

}

//Then you can call the function on which point you want to load the sdk

setupCitizenSdk()

The SDK is a Javascript library that you link to from your page

You can find your public api key in the dashboard in your merchant information page.

Checking that our SDK has been loaded and is ready to be used

Javascript: Check the readiness of the SDK

window.CITIZEN_VERIFIED_PAYIN.ready().then(() => {

//in this point the sdk is ready to be used

})

window.CITIZEN_VERIFIED_PAYIN.ready().then(() => {

//in this point the sdk is ready to be used

})

You are able to check if the CITIZEN_VERIFIED_PAYIN is ready to be used calling the function .ready() of the SDK.

This will return a promise

that will be resolved when SDK is ready to be used.

Creating the Verified Pay-In Instruction

Java: Creating a Verified Pay-In Session

public class CitizenTransactionDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private static final long serialVersionUID = 212345678976543210L;

private String paymentGiro; //Either FPS or SEPA

private String customerIdentifier; // The internal id you use on your systems to identity your user

private String customerEmailAddress;

private String amount;

private String currency; // has to be a valid currency ISO code e.g. USD, EUR, GBP

private String reference;

private String description;

private String customerIpAddress;

private String customerDeviceOs;

private String searchableText;

private String payload;

private boolean isPayloadEncrypted;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String successRedirectUrl;

private String failureRedirectUrl;

private Boolean disableAddingNewBanks;

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-verified-pay-in-endpoint")

public class PayInEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-verified-pay-in-endpoint")

public Callable<ResponseEntity<TextNode>> createCitizenPayInTransaction(TransactionDetails details) {

CitizenTransactionDetails citizenPayInDetails = new CitizenTransactionDetails();

citizenPayInDetails.setCustomerEmailAddress(DB.getCustomerEmail);//only needed for email journey

citizenPayInDetails.setCustomerIdentifier(DB.getCustomerId);//should be the id of the customer's account on the merchant's internal system.

citizenPayInDetails.setAmount(details.getAmount);

citizenPayInDetails.setCurrency("GBP");

citizenPayInDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayInDetails.setReference("This is my reference");

citizenPayInDetails.setDescription("This is my description");

citizenPayInDetails.setCustomerIpAddress(details.getCustomerIpAddress());

citizenPayInDetails.setCustomerDeviceOs(details.getCustomerDeviceOs());

citizenPayInDetails.setSearchableText(details.getSearchableText());

citizenPayInDetails.setPayload(details.getPayload());

citizenPayInDetails.setIsPayloadEncrypted(details.getIsPayloadEncrypted());

citizenPayInDetails.setDisableAddingNewBanks(details.getDisableAddingNewBanks());

citizenPayInDetails.setSupportedCountries(DB.getSupportedCountries());

citizenPayInDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

citizenPayInDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

citizenPayInDetails.setBankSuccessRedirectUrl("<my-bank-success-redirect-url>");

citizenPayInDetails.setBankFailureRedirectUrl("<my-bank-failure-redirect-url>");

citizenPayInDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("AuthorizationCitizen", [YOUR_MERCHANT_PRIVATE_API_KEY]]);

ResponseEntity<TextNode> payInInitResponse = restTemplate

.exchange("https://api.yaspa.com/v2/payins/verified/session", HttpMethod.POST,

new HttpEntity<>(citizenPayInDetails, httpHeaders), TextNode.class);

String citizenTransactionId = payInInitResponse.getBody().asText();

return ResponseEntity.ok(new TextNode(citizenTransactionId)); //Return this to your front end

}

}

public class CitizenTransactionDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private static final long serialVersionUID = 212345678976543210L;

private String paymentGiro; //Either FPS or SEPA

private String customerIdentifier; // The internal id you use on your systems to identity your user

private String customerEmailAddress;

private String amount;

private String currency; // has to be a valid currency ISO code e.g. USD, EUR, GBP

private String reference;

private String description;

private String customerIpAddress;

private String customerDeviceOs;

private String searchableText;

private String payload;

private boolean isPayloadEncrypted;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String successRedirectUrl;

private String failureRedirectUrl;

private Boolean disableAddingNewBanks;

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-verified-pay-in-endpoint")

public class PayInEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-verified-pay-in-endpoint")

public Callable<ResponseEntity<TextNode>> createCitizenPayInTransaction(TransactionDetails details) {

CitizenTransactionDetails citizenPayInDetails = new CitizenTransactionDetails();

citizenPayInDetails.setCustomerEmailAddress(DB.getCustomerEmail);//only needed for email journey

citizenPayInDetails.setCustomerIdentifier(DB.getCustomerId);//should be the id of the customer's account on the merchant's internal system.

citizenPayInDetails.setAmount(details.getAmount);

citizenPayInDetails.setCurrency("GBP");

citizenPayInDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayInDetails.setReference("This is my reference");

citizenPayInDetails.setDescription("This is my description");

citizenPayInDetails.setCustomerIpAddress(details.getCustomerIpAddress());

citizenPayInDetails.setCustomerDeviceOs(details.getCustomerDeviceOs());

citizenPayInDetails.setSearchableText(details.getSearchableText());

citizenPayInDetails.setPayload(details.getPayload());

citizenPayInDetails.setIsPayloadEncrypted(details.getIsPayloadEncrypted());

citizenPayInDetails.setDisableAddingNewBanks(details.getDisableAddingNewBanks());

citizenPayInDetails.setSupportedCountries(DB.getSupportedCountries());

citizenPayInDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

citizenPayInDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

citizenPayInDetails.setBankSuccessRedirectUrl("<my-bank-success-redirect-url>");

citizenPayInDetails.setBankFailureRedirectUrl("<my-bank-failure-redirect-url>");

citizenPayInDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("AuthorizationCitizen", [YOUR_MERCHANT_PRIVATE_API_KEY]]);

ResponseEntity<TextNode> payInInitResponse = restTemplate

.exchange("https://testapi.yaspa.com/v2/payins/verified/session", HttpMethod.POST,

new HttpEntity<>(citizenPayInDetails, httpHeaders), TextNode.class);

String citizenTransactionId = payInInitResponse.getBody().asText();

return ResponseEntity.ok(new TextNode(citizenTransactionId)); //Return this to your front end

}

}

Setting up a verified pay-in in your backend is simple, and requires a number of fields set.

| Parameter | Description | Type | Required |

|---|---|---|---|

| customerIdentifier | The internal id you use on your systems to identity your user | string | Y |

| customerEmailAddress | The email of the paying customer. Only needed for email journey | string | N |

| paymentGiro | payment type (SEPA or FPS) | string | Y |

| amount | decimal value of the payment | string with valid 2 decimal number format | Y |

| currency | currency | string with valid ISO currency code | Y |

| reference | payment reference shown to the customer. Needs to be alphanumeric and 15 chars max. This MUST be unique | string | Y |

| description | description shown to the customer | string | N |

| customerIpAddress | IP for the paying customer | string with valid IPv4 or IPv6 format | Y |

| customerDeviceOs | OS for the paying customer | string | Y |

| searchableText | searchable string | string | N |

| payload | meta-data of the payment | string | N |

| isPayloadEncrypted | encrypt payload field (true/false) | boolean | N |

| supportedCountries | filter the bank list in bank selection page | array of string country ISO codes | N |

| successRedirectUrl | It redirect the page that the modal is shown in completion of the journey | string | N |

| failureRedirectUrl | It redirect the page that the modal is shown in case of closing the modal on failed status | string | N |

| successBankRedirectUrl | Url that the user is redirected to from their bank app on a successful approval | string | N |

| failureBankRedirectUrl | Url that the user is redirected to from their bank app on a cancelled/failed request | string | N |

| disableAddingNewBanks | Prevents user from removing existing bank accounts or adding new ones | boolean | N |

| language | The language that will be used to translate the journey | string of language ISO-639-1 code. Default value 'en' | N |

Starting the No Email Verified Pay-In Journey (Direct Verified Pay-Ins)

You may not want the user to be sent an email to begin their verified pay-in journey. For this, we offer a way to start the journey on the current page.

This call will redirect the user from the current page to a consent page with the details of the journey.

Javascript: Starting the Verified Pay-In Journey

<script>

// citizenTransactionId - from the previous step

let sendVerifiedPayIn = function (citizenTransactionId) {

window.CITIZEN_VERIFIED_PAYIN.startVerifiedPayInJourney(citizenTransactionId);

}

</script>

Once you have the citizenTransactionId, you can start the verified pay-in journey.

Starting the QR code Verified Pay-In Journey

You may not want the user to be sent an email to begin their verified pay-in journey. For this, we offer a way to show to the user

a QR code, where he will be able to scan it and continue the journey on his device.

Javascript: Starting the QR code Verified Pay-In Journey

<script>

// citizenTransactionId - from the previous step

// options - an object that can contain the following optional fields:

// 1. initiatedCallback - a callback that is triggered when the background work is done and the modal is shown.

// Used mostly to handle the loading state of the host page. If non is passed, the loading state is handled from the modal

//

// e.g. const options = {

// initiatedCallback: function(){console.log("This function called when the modal is about to open")}

// }

let sendQrVerifiedPayIn = function (citizenTransactionId) {

window.CITIZEN_VERIFIED_PAYIN.startQRCodeVerifiedPayInJourney(citizenTransactionId, options);

}

</script>

Once you have the citizenTransactionId, you can start the QR code verified pay-in journey.

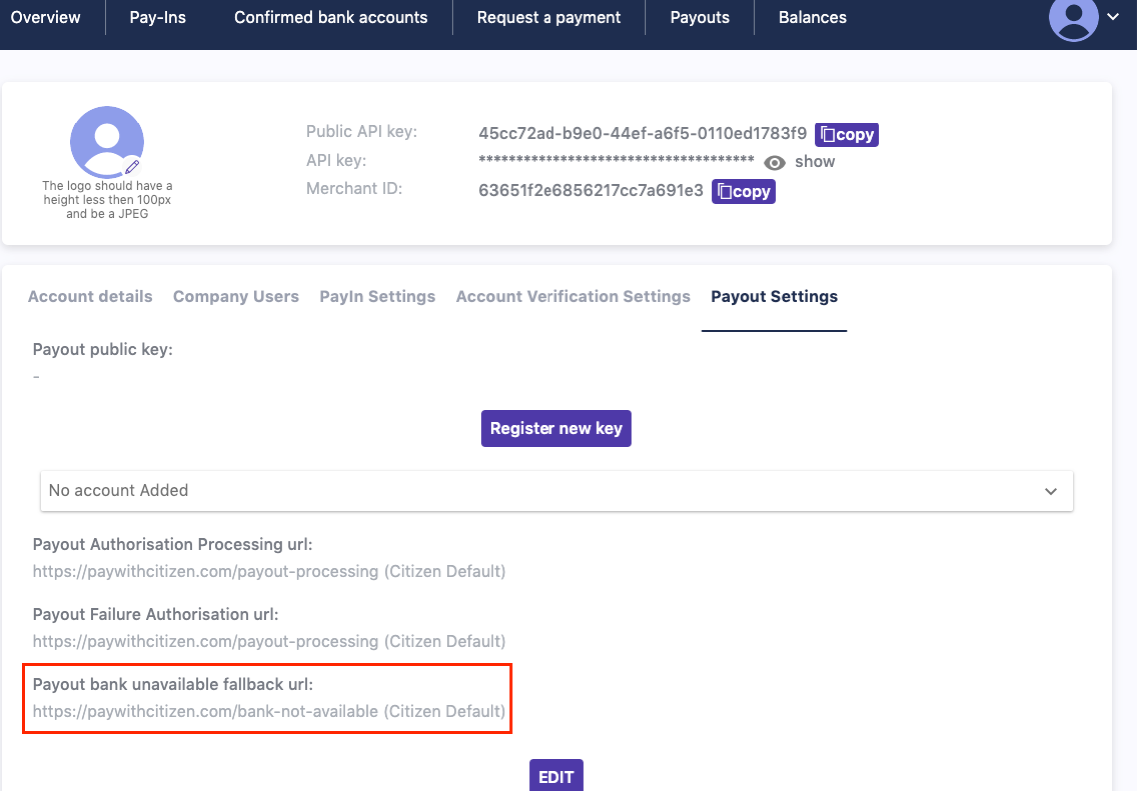

Integrating Verified Payouts

Yaspa lets you handle payouts to your customers after they have verified the bank account to which they wish to receive money. Before payouts can be enabled a RSA public key needs to be registered with Yaspa which is used to verify signed payout requests. Payouts are handled with the following calls:

A signed request is sent from your back end to Yaspa

This call initiates the payout and creates a temporary payout session.

A JavaScript SDK call is made from your front end to start the payout journey for your customer.

This call redirects your customer to their bank to confirm their bank account and then completes the payout. A permanent record of the payout is kept after this call.

If back office confirmation is needed before transferring money to a customer then a queued payout can be created. A queued payouts are handled as follows:

A signed request is sent from your back end to Yaspa

This call initiates the payout and creates a temporary payout session. The request body should have the

queueparameter set.A JavaScript SDK call is made from your front end to start the payout journey for your customer.

This call redirects your customer to their bank to confirm their bank account but does not complete the payout.

The payout is confirmed or rejected on your merchant dashboard.

If the payout is confirmed then money is transaferred to your customer's confirmed bank account. Otherwise the payout is marked as rejected and no further action is taken.

Public Key Registration

For our system to be able to verify your payout requests, the public component of the openssl RSA key pair is required. This key is used to sign the requests for the payouts and is registered on our system through the admin dashboard.

Create a Public/Private Key Pair

Bash: Generate private key

openssl genpkey -algorithm RSA -outform PEM -out private_key.pem -pkeyopt rsa_keygen_bits:2048

A prerequisite for signing any request is to generate an RSA 2048 bit keypair using OpenSSL.

By executing the first block, a 2048 bit RSA key named private_key.pem is generated, which will be the private key.

Bash: Generate public key

openssl rsa -in private_key.pem -pubout -out public_key.pub

The second step is generating a public key based on the private key. This can be easily done by executing the second block of code, which will generate a public key named public_key.pub

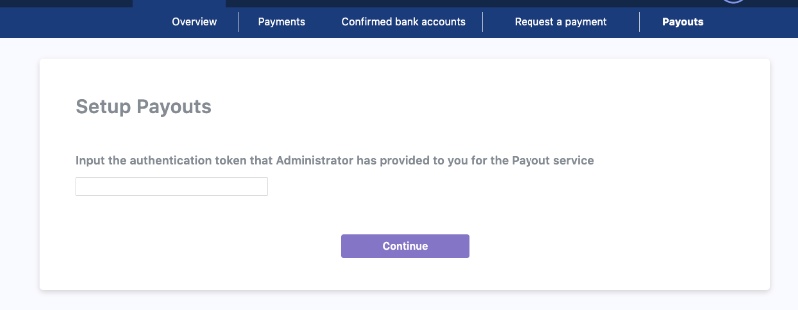

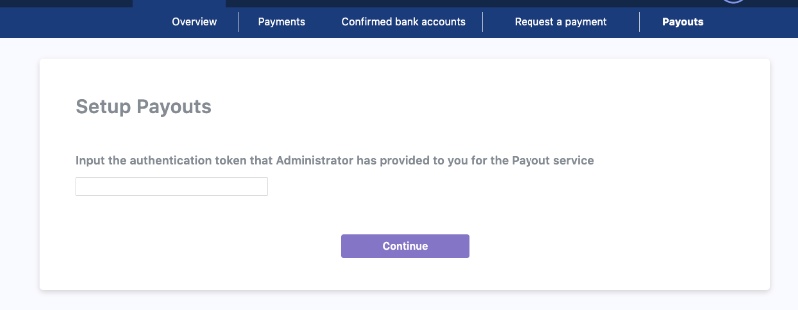

Request Authorisation Token

An authorisation token will be provided by Yaspa for the merchant to be able to start the payout journey. When the token is provided to you, you can submit it on the admin dashboard under the payout section.

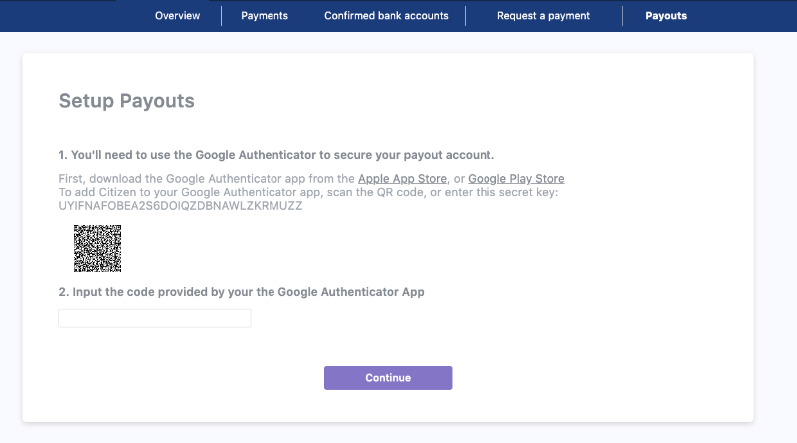

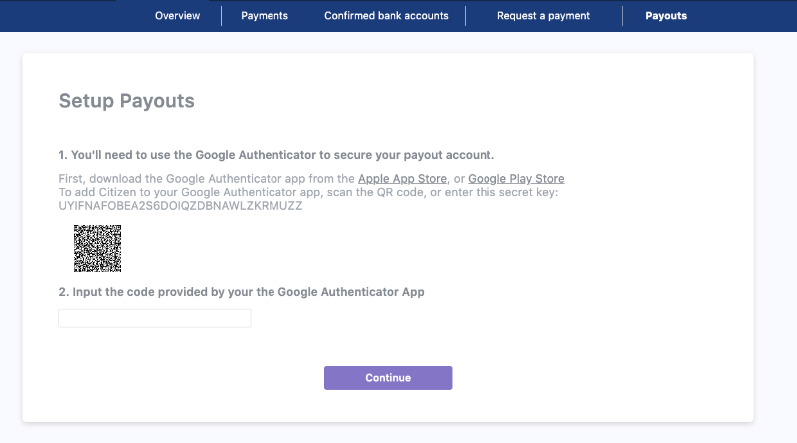

Register Google authenticator

Once the token has been entered, you will need to setup Google authenticator to make sure the key cannot be easily changed.

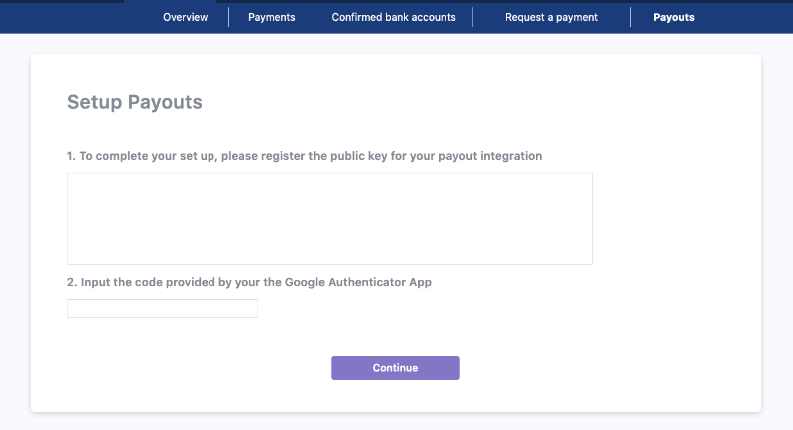

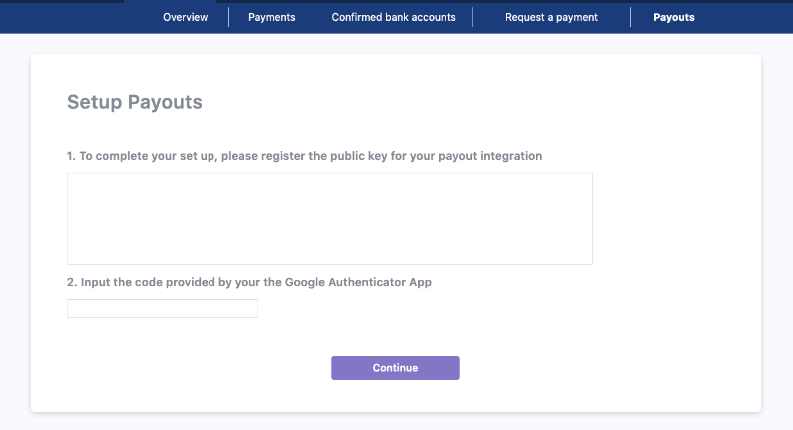

Register Public component

Once Google Authenticator has been setup, you can register the public key from your RSA key pair that you will use to sign requests.

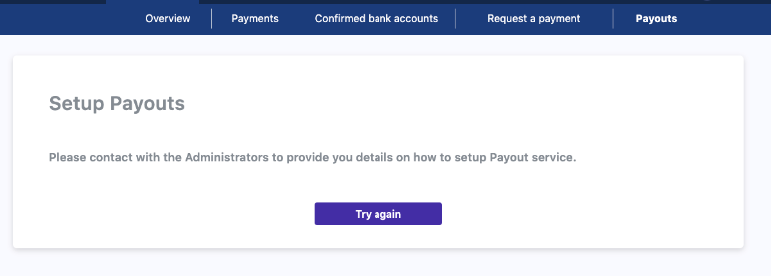

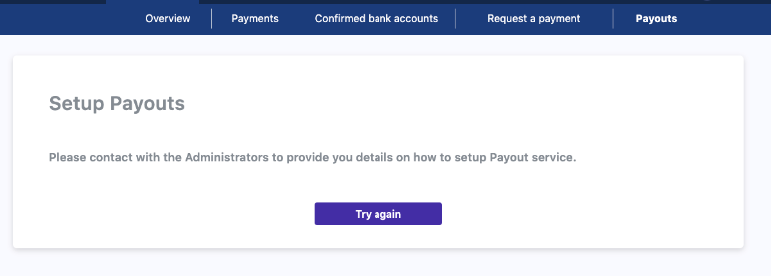

No Authorisation token

If there isn't any authorisation token registered for your entity, you need to ask for one from Yaspa and try again after receiving it.

Creating the Verified Payout Instruction

Java: Creating a Verified Payout Session

public class CitizenTransactionDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private static final long serialVersionUID = 212345678976543210L;

private String paymentGiro; //Either FPS or SEPA

private String customerEmailAddress;

private String merchantEmailAddress;

private String merchantId;

private String amount;

private String currency; // has to be a valid currency ISO code e.g. USD, EUR, GBP

private String reference;

private String merchantBankCode;

private String merchantAccountNumber;

private String customerIpAddress;

private String customerDeviceOs;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String successRedirectUrl;

private String failureRedirectUrl;

private boolean queue;

private String heldReason;

private Boolean disableAddingNewBanks;

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-payments-endpoint")

public class PaymentEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-payment-endpoint")

public Callable<ResponseEntity<TextNode>> createCitizenPaymentTransaction(TransactionDetails details) {

CitizenTransactionDetails citizenPayoutDetails = new CitizenTransactionDetails();

citizenPayoutDetails.setCustomerEmailAddress(DB.getCustomerEmail());//only needed for email journey

citizenPayoutDetails.setMerchantId(details.getMerchantId());

citizenPayoutDetails.setAmount(details.getAmount());

citizenPayoutDetails.setCurrency("GBP");

citizenPayoutDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayoutDetails.setReference("MyShortReference123");

citizenPayoutDetails.setCustomerIpAddress(details.getCustomerIpAddress());

citizenPayoutDetails.setCustomerDeviceOs(details.getCustomerDeviceOs());

citizenPayoutDetails.setSupportedCountries(DB.getSupportedCountries());

citizenPayoutDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

citizenPayoutDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

citizenPayoutDetails.setQueue(DB.shouldPayoutQueued());

citizenPayoutDetails.setHeldReason(DB.getHeldReason());

citizenPayoutDetails.setDisableAddingNewBanks(details.getDisableAddingNewBanks());

citizenPayoutDetails.setBankSuccessRedirectUrl("<my-bank-success-redirect-url>");

citizenPayoutDetails.setBankFailureRedirectUrl("<my-bank-failure-redirect-url>");

citizenPayoutDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

String citizenVerifiedPayoutUrl = "https://api.yaspa.com/v2/payouts/verified/session";

HttpHeaders httpHeaders = generateHeadersForSignedRequest(HttpMethod.POST,

citizenVerifiedPayoutUrl,

citizenPayoutDetails,

DB.getPrivateKey);

httpHeaders.set("AuthorizationCitizen", [YOUR_ENTITY_API_KEY]]);

ResponseEntity<TextNode> payoutInitResponse = restTemplate

.exchange(citizenVerifiedPayoutUrl, HttpMethod.POST,

new HttpEntity<>(citizenPayoutDetails, httpHeaders), TextNode.class);

String citizenPayoutTransactionId = payoutInitResponse.getBody().asText();

return ResponseEntity.ok(new TextNode(citizenPayoutTransactionId)); //Return this to your front end

}

}

private HttpHeaders generateHeadersForSignedRequest (

HttpMethod httpMethod, String url, Object requestBody, PrivateKey privateKey)

throws JsonProcessingException, SignatureException {

String requestExpiryTime = String.valueOf(Instant.now().getEpochSecond() + 300);

String textToSign = requestExpiryTime + "|" + httpMethod.name().toUpperCase() + "|" + url + "|";

if (requestBody != null) {

ObjectMapper objectMapper = new ObjectMapper();

objectMapper.setSerializationInclusion(JsonInclude.Include.NON_NULL);

ObjectWriter objectWriter = objectMapper.writer();

String requestJson = objectWriter.writeValueAsString(requestBody);

textToSign += requestJson;

}

String signature = generateSignature(textToSign, privateKey);

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("Signature", signature);

httpHeaders.set("Expires-at", requestExpiryTime);

return httpHeaders;

}

private String generateSignature(String plainText, PrivateKey privateKey)

throws SignatureException {

try {

Signature signature = Signature.getInstance("SHA256withRSA");

signature.initSign(privateKey);

signature.update(plainText.getBytes("UTF8"));

byte[] valueSigned = signature.sign();

return Base64.getEncoder().encodeToString(valueSigned);

} catch (NoSuchAlgorithmException | InvalidKeyException | UnsupportedEncodingException e) {

throw new SignatureException(e);

}

}

public class CitizenTransactionDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private static final long serialVersionUID = 212345678976543210L;

private String paymentGiro; //Either FPS or SEPA

private String customerEmailAddress;

private String merchantEmailAddress;

private String merchantId;

private String amount;

private String currency; // has to be a valid currency ISO code e.g. USD, EUR, GBP

private String reference;

private String merchantBankCode;

private String merchantAccountNumber;

private String customerIpAddress;

private String customerDeviceOs;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String successRedirectUrl;

private String failureRedirectUrl;

private boolean queue;

private String heldReason;

private Boolean disableAddingNewBanks;

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-payments-endpoint")

public class PaymentEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-payment-endpoint")

public Callable<ResponseEntity<TextNode>> createCitizenPaymentTransaction(TransactionDetails details) {

CitizenTransactionDetails citizenPayoutDetails = new CitizenTransactionDetails();

citizenPayoutDetails.setCustomerEmailAddress(DB.getCustomerEmail());//only needed for email journey

citizenPayoutDetails.setMerchantId(details.getMerchantId());

citizenPayoutDetails.setAmount(details.getAmount());

citizenPayoutDetails.setCurrency("GBP");

citizenPayoutDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayoutDetails.setReference("MyShortReference123");

citizenPayoutDetails.setCustomerIpAddress(details.getCustomerIpAddress());

citizenPayoutDetails.setCustomerDeviceOs(details.getCustomerDeviceOs());

citizenPayoutDetails.setSupportedCountries(DB.getSupportedCountries());

citizenPayoutDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

citizenPayoutDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

citizenPayoutDetails.setQueue(DB.shouldPayoutQueued());

citizenPayoutDetails.setHeldReason(DB.getHeldReason());

citizenPayoutDetails.setDisableAddingNewBanks(details.getDisableAddingNewBanks());

citizenPayoutDetails.setBankSuccessRedirectUrl("<my-bank-success-redirect-url>");

citizenPayoutDetails.setBankFailureRedirectUrl("<my-bank-failure-redirect-url>");

citizenPayoutDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

String citizenVerifiedPayoutUrl = "https://testapi.yaspa.com/v2/payouts/verified/session";

HttpHeaders httpHeaders = generateHeadersForSignedRequest(HttpMethod.POST,

citizenVerifiedPayoutUrl,

citizenPayoutDetails,

DB.getPrivateKey);

httpHeaders.set("AuthorizationCitizen", [YOUR_ENTITY_API_KEY]]);

ResponseEntity<TextNode> payoutInitResponse = restTemplate

.exchange(citizenVerifiedPayoutUrl, HttpMethod.POST,

new HttpEntity<>(citizenPayoutDetails, httpHeaders), TextNode.class);

String citizenPayoutTransactionId = payoutInitResponse.getBody().asText();

return ResponseEntity.ok(new TextNode(citizenPayoutTransactionId)); //Return this to your front end

}

}

private HttpHeaders generateHeadersForSignedRequest (

HttpMethod httpMethod, String url, Object requestBody, PrivateKey privateKey)

throws JsonProcessingException, SignatureException {

String requestExpiryTime = String.valueOf(Instant.now().getEpochSecond() + 300);

String textToSign = requestExpiryTime + "|" + httpMethod.name().toUpperCase() + "|" + url + "|";

if (requestBody != null) {

ObjectMapper objectMapper = new ObjectMapper();

objectMapper.setSerializationInclusion(JsonInclude.Include.NON_NULL);

ObjectWriter objectWriter = objectMapper.writer();

String requestJson = objectWriter.writeValueAsString(requestBody);

textToSign += requestJson;

}

String signature = generateSignature(textToSign, privateKey);

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("Signature", signature);

httpHeaders.set("Expires-at", requestExpiryTime);

return httpHeaders;

}

private String generateSignature(String plainText, PrivateKey privateKey)

throws SignatureException {

try {

Signature signature = Signature.getInstance("SHA256withRSA");

signature.initSign(privateKey);

signature.update(plainText.getBytes("UTF8"));

byte[] valueSigned = signature.sign();

return Base64.getEncoder().encodeToString(valueSigned);

} catch (NoSuchAlgorithmException | InvalidKeyException | UnsupportedEncodingException e) {

throw new SignatureException(e);

}

}

Setting up a verified payout in your backend is simple, and requires a number of fields set.

| Parameter | Description | Type | Required |

|---|---|---|---|

| merchantId | Your merchantId. This can be obtained from the admin dashboard | string | Y |

| customerIdentifier | Used to identify the customer receiving the payout. This can be an identifier internal to your system | string | Y |

| customerEmailAddress | Customer email address which is used if using the payout journey | string | N |

| amount | Decimal value of the payout - string with number with 2 decimal places | string | Y |

| currency | string with valid ISO currency code | string | Y |

| paymentGiro | payment type (SEPA or FPS) | string | Y |

| reference | Reference for the payout (max 15 chars). This MUST be unique | string | Y |

| customerDeviceOs | OS for the customer receiving the payout | string | Y |

| customerIpAddress | IP address of the customer receiving the payout | string with valid IPv4 or IPv6 format | Y |

| searchableText | searchable string | string | N |

| payload | meta-data of the payment | string | N |

| payloadEncrypted | encrypt payload field (true/false) | boolean | N |

| supportedCountries | filter the bank list in bank selection page | array of string country ISO codes | N |

| successRedirectUrl | Url that the user is redirected to from the modal on completion of a successful payout journey | string | N |

| failureRedirectUrl | Url that the user is redirected to from the modal on completion of a failed payout journey | string | N |

| successBankRedirectUrl | Url that the user is redirected to from their bank selection screen on a successful approval | string | N |

| failureBankRedirectUrl | Url that the user is redirected to from their bank selection screen on a cancelled/failed request | string | N |

| queue | determine if the payout will added to queue and waiting for manual confirmation or submitted right away | boolean | N |

| heldReason | the reason that a payout added to a queue | string | N |

| disableAddingNewBanks | Prevents user from removing existing bank accounts or adding new ones | boolean | N |

| language | The language that will be used to translate the journey | string of language ISO-639-1 code. Default value 'en' | N |

Payout Request Signature

The request must be signed to authenticate the merchant. The signature is valid until a given expiry time set by the merchant (max 10 minutes from the time the request is made).

The signature plain text is generated by concatenating the request components, each one separated by the '|' delimiter:

expiryTime | httpMethod | url | requestBody

If the request body is not present in the request then the signature plain text is as follows:

expiryTime | httpMethod | url |

| Component | Description |

|---|---|

| expiryTime | Integer UNIX timestamp for signature expiry time |

| httpMethod | String HTTP method (GET, POST etc) in upper case |

| url | String URL of the endpoint |

| requestBody | String representation of the JSON request body if present |

An example of the signature plain text is as follows

1613639354|POST|https://api.yaspa.com/v1/payouts/verified-payout-session|{"customerEmailAddress":"john.doe@test.com","merchantEmailAddress":"info@trading.com","merchantInternalId":"john.doe","currency":"GBP","paymentGiro":"FPS","merchantBankCode":"608384","merchantAccountNumber":"40027188","amount":"5.50","reference":"Monthly pay out."}

1613639354|POST|https://testapi.yaspa.com/v1/payouts/verified-payout-session|{"customerEmailAddress":"john.doe@test.com","merchantEmailAddress":"info@trading.com","merchantInternalId":"john.doe","currency":"GBP","paymentGiro":"FPS","merchantBankCode":"608384","merchantAccountNumber":"40027188","amount":"5.50","reference":"Monthly pay out."}

The signature plain text is signed by an RSA 2048 bit key, the public part of which will have been registered on the Yaspa service in advance. It is base 64 encoded and set in a header.

Adding the JS Verified Payout SDK to your page

Javascript: Adding the JS Verified Payout SDK

<script src="https://sdk.yaspa.com/v6/sdk/sdk-payout.js" data-api-key="[Your-merchant-public-api-key]"></script>

<script src="https://test-sdk.yaspa.com/v6/sdk/sdk-payout.js" data-api-key="[Your-merchant-public-api-key]"></script>

Javascript: Adding the JS Verified Payout SDK programmatically

function setupCitizenSdk() {

let scriptTag = document.createElement('script');

scriptTag.src = "https://sdk.yaspa.com/v6/sdk/sdk-payout.js";

scriptTag.dataset.apiKey = "[Your-merchant-public-api-key]"

document.body.appendChild(scriptTag)

}

//Then you can call the function on which point you want to load the sdk

setupCitizenSdk()

function setupCitizenSdk() {

let scriptTag = document.createElement('script');

scriptTag.src = "https://test-sdk.yaspa.com/v6/sdk/sdk-payout.js";

scriptTag.dataset.apiKey = "[Your-merchant-public-api-key]"

document.body.appendChild(scriptTag)

}

//Then you can call the function on which point you want to load the sdk

setupCitizenSdk()

The SDK is a Javascript library that you link to from your page You can find your public api key in the dashboard in your merchant information page.

Checking that our SDK has been loaded and is ready to be used

Javascript: Check the readiness of the SDK

window.CITIZEN_PAYOUT.ready().then(() => {

//in this point the sdk is ready to be used

})

window.CITIZEN_PAYOUT.ready().then(() => {

//in this point the sdk is ready to be used

})

You are able to check if the CITIZEN_PAYOUT is ready to be used calling the function .ready() of the SDK.

This will return a promise

that will be resolved when SDK is ready to be used.

Starting the Verified Payout Journey (Direct Verified Payouts)

Javascript: Starting the Verified Payout Journey

<script>

// transactionId - from the previous step

let sendVerifiedPayout = function (transactionId) {

window.CITIZEN_PAYOUT.startVerifiedPayoutJourney(transactionId);

}

</script>

Once you have the transaction ID, you can start the verified payout journey.

This call will redirect the user from the current page to a consent page with the details of the journey.

Starting the QR code Verified Payout Journey

You may not want the user to be sent an email to begin their verified payout journey. For this, we offer a way to show to the user

a QR code, where he will be able to scan it and continue the journey on his device.

Javascript: Starting the QR code Verified Payout Journey

<script>

// citizenTransactionId - from the previous step

// options - an object that can contain the following optional fields:

// 1. initiatedCallback - a callback that is triggered when the background work is done and the modal is shown.

// Used mostly to handle the loading state of the host page. If non is passed, the loading state is handled from the modal

//

// e.g. const options = {

// initiatedCallback: function(){console.log("This function called when the modal is about to open")}

// }

let sendQrVerifiedPayIn = function (citizenTransactionId) {

window.CITIZEN_PAYOUT.startQRCodeVerifiedPayoutJourney(citizenTransactionId, options);

}

</script>

Once you have the citizenTransactionId, you can start the QR code verified payout journey.

Hosted Journeys

Hosted journeys are a way for you to make use of SDK without having to incorporate it into your site. You can just generate a link to a page that we host and then redirect your user to. This way you do not need to worry about how to display the correct details or integrating/updating our SDK

Pay-Ins

Url

https://api.yaspa.com/v2/payins/hosted-payin/generate-link

https://testapi.yaspa.com/v2/payins/hosted-payin/generate-link

Use the following to make use of our standard pay-in journey.

To generate the link you will need to call the following endpoint from your backend as it will use your merchant private api key

Java: Generating Hosted Pay-In Link

public class HostedPayInDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private String customerIdentifier;

private String amount;

private String currency;

private PaymentGiro paymentGiro;

private String reference;

private String description;

private String searchableText;

private String payload;

private boolean isPayloadEncrypted;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-hosted-payIn-endpoint")

public class HostedPayInEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-payin-endpoint")

public ResponseEntity<*> createCitizenHostedPayIn(HostedPayInDetails details) {

HostedPayInDetails citizenPayInDetails = new HostedPayInDetails();

citizenPayInDetails.setCustomerIdentifier("info@company.com");

citizenPayInDetails.setAmount(details.getAmount);

citizenPayInDetails.setCurrency("GBP");

citizenPayInDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayInDetails.setReference("MyPaymentReference123");

citizenPayInDetails.setDescription("This is my description for the payment");

citizenPayInDetails.setJourneyType("HOSTED_PAYMENT");

citizenPayInDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

citizenPayInDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

citizenPayInDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("AuthorizationCitizen", [YOUR_MERCHANT_PRIVATE_API_KEY]]);

ResponseEntity<*> HostedPayInLinkResponse = restTemplate

.exchange("https://api.yaspa.com/v2/payins/hosted-payin/generate-link", HttpMethod.POST,

new HttpEntity<>(citizenPayInDetails, httpHeaders), String.class);

String hostedPayInLink = HostedPayInLinkResponse.getBody();

return ResponseEntity.ok(hostedPayInLink); //Return this to your front end

}

}

public class HostedPayInDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private String customerIdentifier;

private String amount;

private String currency;

private PaymentGiro paymentGiro;

private String reference;

private String description;

private String searchableText;

private String payload;

private boolean isPayloadEncrypted;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-hosted-payin-endpoint")

public class HostedPayInEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-payin-endpoint")

public ResponseEntity<*> createCitizenHostedPayIn(HostedPayInDetails details) {

HostedPayInDetails citizenPayInDetails = new HostedPayInDetails();

citizenPayInDetails.setCustomerIdentifier("info@company.com");

citizenPayInDetails.setAmount(details.getAmount);

citizenPayInDetails.setCurrency("GBP");

citizenPayInDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayInDetails.setReference("MyPaymentReference123");

citizenPayInDetails.setDescription("This is my description for the payment");

citizenPayInDetails.setJourneyType("HOSTED_PAYMENT");

citizenPayInDetails.setSuccessRedirectUrl("<my-success-redirect-url>");

citizenPayInDetails.setFailureRedirectUrl("<my-failure-redirect-url>");

citizenPayInDetails.setLanguage(details.getLanguage());

RestTemplate restTemplate = new RestTemplate();

HttpHeaders httpHeaders = new HttpHeaders();

httpHeaders.set("AuthorizationCitizen", [YOUR_MERCHANT_PRIVATE_API_KEY]]);

ResponseEntity<*> HostedPayInLinkResponse = restTemplate

.exchange("https://testapi.yaspa.com/v2/payins/hosted-payin/generate-link", HttpMethod.POST,

new HttpEntity<>(citizenPayInDetails, httpHeaders), String.class);

String hostedPayInLink = HostedPayInLinkResponse.getBody();

return ResponseEntity.ok(hostedPayInLink); //Return this to your front end

}

}

| Parameter | Description | Type | Required |

|---|---|---|---|

| customerIdentifier | The internal id you use on your systems to identity your user | String | Y |

| paymentGiro | either FPS (UK faster payments) or SEPA (EU SEPA Inst) | String | Y |

| amount | A valid payment amount (2 decimal digit number) | String with valid 2 decimal number format | Y |

| currency | currency | String with valid ISO currency code | Y |

| reference | the reference shown to the customer in their bank statement. Needs to be alphanumeric and 15 chars max. This MUST be unique | String | Y |

| journeyType | the type of the journey, payin (HOSTED_PAYMENT) or verified payin (HOSTED_VERIFIED_PAYMENT) | String | Y |

| description | A description that will show up on the hosted page to describe what the pay-in is for. | String | N |

| searchableText | a string that you can use to search for this pay-in | String | N |

| payload | a string payload that can take any format e.g. JSON object | String | N |

| isPayloadEncrypted | A boolean to specify whether you want to encrypt your payload (default: false) | Boolean | N |

| supportedCountries | filter the bank list in bank selection page | array of string country ISO codes | N |

| successRedirectUrl | the page redirection for a successful payin | String | N |

| failureRedirectUrl | the page redirection for a failure payin | String | N |

| successBankRedirectUrl | Url that the user is redirected to from their bank app on a successful approval | string | N |

| failureBankRedirectUrl | Url that the user is redirected to from their bank app on a cancelled/failed request | string | N |

| language | The language that will be used to translate the journey | string of language ISO-639-1 code. Default value 'en' | N |

You will then get a URL to the hosted page. It has an expiry of 1 week. Once expired you will need to generate a new hosted pay-in.

Response

https://banks.yaspa.com/hosted?transaction-id=fab54752-ddfe-7d61-40a8-51a49a

https://test-banks.yaspa.com/hosted?transaction-id=fab54752-ddfe-7d61-40a8-51a49a

Verified Pay-Ins

Url

https://api.yaspa.com/v2/payins/hosted-payin/generate-link

https://testapi.yaspa.com/v2/payins/hosted-payin/generate-link

Use the following to make use of our standard pay-in journey.

To generate the link you will need to call the following endpoint from your backend as it will use your merchant private api key

Java: Generating Hosted Verified Pay-In Link

public class HostedPayInDetails implements Serializable {

// This is just a Java class that represents the json object that you will need to send to the Yaspa backend.

// These are required fields.

private String customerIdentifier;

private String amount;

private String currency;

private PaymentGiro paymentGiro;

private String reference;

private String description;

private String searchableText;

private String payload;

private boolean isPayloadEncrypted;

private List<String> supportedCountries; // has to be an array of valid country ISO codes e.g GB, NL

private String language;

//Getters and Setters

}

@RestController

@RequestMapping(value = "my-hosted-verified-payIn-endpoint")

public class HostedPayInEndpoints {

//Your backend will then make a request to the Yaspa service to create a transaction.

@RequestMapping(method = RequestMethod.POST, path = "/your-example-payin-endpoint")

public ResponseEntity<*> createCitizenHostedPayIn(HostedPayInDetails details) {

HostedPayInDetails citizenPayInDetails = new HostedPayInDetails();

citizenPayInDetails.setCustomerIdentifier("info@company.com");

citizenPayInDetails.setAmount(details.getAmount);

citizenPayInDetails.setCurrency("GBP");

citizenPayInDetails.setPaymentGiro(PaymentGiro.FPS);

citizenPayInDetails.setReference("MyPaymentReference123");

citizenPayInDetails.setDescription("This is my description for the payment");

citizenPayInDetails.setJourneyType("HOSTED_VERIFIED_PAYMENT");

citizenPayInDetails.setSuccessRedirectUrl("<my-success-redirect-url>");